October 11, 2019

THE INNOVATION ENVIROMMENT: Space Race 2.0

The new space race is much more intricate than the cold war contest between the US and the Soviet Union and perhaps, ultimately more lucrative.

Pioneering government agencies, like NASA or Roscosmos (Russia) now face competition from private corporate space programs as well as national programs in China and India.

Everything from advancing propulsion systems, space tourism, GPS satellites to colonizing Mars are up for grabs.

Of particular interest, private companies themselves have space ambitions that go well beyond government contracts.

Below is an overview of the major players in the modern space race.

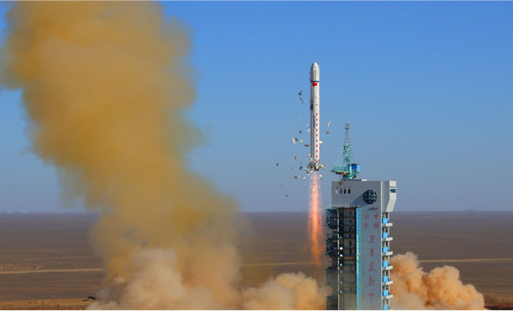

CHINA

The Beijing government views space as vital for boosting the economy and promoting advanced technologies.

They see space as a very important driver for growth and competitiveness going forward.

The China National Space Agency (CNSA), known for building its own human space flight program without help from the Americans, launched more satellites in 2018 than any other country.

Whereas US and Russian space programs struggle with budgets and funding, China is expanding its investments on every front, including communications, reconnaissance satellites, GPS and human spaceflight.

Major ambitions of the CNSA include:

- Mission to Mars: 2021

- Crewed lunar landing: 2030

THE U.S.

NASA is known for constantly wanting to be on the cutting edge of technology and mission planning.

They sent the first (and so far the only) humans to the Moon, they hold the records for first probes to visit all the outer planets and even Pluto.

NASA’s Jet Propulsion Lab is the global leader of interplanetary communication, telemetry and travel.

INDIA

India is looking to take a giant leap in its space program and solidify its place among the world's spacefaring nations, attempting its second unmanned mission to the moon last month.

Like China, the Indian Space Research Organization (ISRO) is eager to showcase the country's capabilities in technology.

In 2013 India put a satellite into orbit around Mars in the nation's first interplanetary mission.

India also plans to send humans into space by 2022, becoming only the fourth nation to do so.

RUSSIA

Roscosmos is known for dominating the first two thirds of the Space Race of the 1950s and 60s.

Currently the organization is the only human space flight provider to the international community.

Their cosmonauts have more space station experience than anyone else: while NASA kept working away at the Shuttle program, Roscosmos launched 6 space stations, creating expertise that may give them an advantage in the future.

CORPORATIONS

To date, Chinese and US companies are developing most aggressively.

In the US, lucrative government contracts for space launches are awarded to private companies.

Winners get 25 launches, paying $100 - $150 million per launch, which provides plenty of cash to pursue private space exploration agendas.

Beyond government partnerships and contracts, in the US and UK, ‘billionaire-funding’ generally geared toward rockets fit for human travel, are slowly moving forward on their own, privately funded agendas.

China started developing a private space industry in 2014, pledging to encourage private capital’s participation in China’s construction of civilian space infrastructure.

Since then, military-civilian partnerships have become commonplace and private firms have been allowed to launch from military bases.

In China’s commercial space industry, a group of private firms are launching satellites and exploring other money-making applications for space travel.